Retail registers skimmed nightly. Construction draw requests inflated 14 %. Condo reserves vanished. Whatever the flavor, hidden money costs real money, but it leaves digital footprints. Our CPA & CrFA team converts those footprints into evidence that wins trials and settlements

Trace stolen cash, inventory, and fixed assets; deliver court-ready evidence that recovers misappropriated dollars.

Detect inflated revenue, hidden liabilities, and cooked books; produce defensible reports that withstand auditor and legal scrutiny.

Uncover ghost employees, inflated hours, and fake receipts; convert red flags into bulletproof documentation for litigation.

Uncover insider theft, falsified records, and diverted funds; compile airtight evidence to recover losses and hold perpetrators accountable.

HOA Dues Theft

Management company was stealing homeowner’s dues from absent homeowners. Management company transferred funds directly from HOA bank account into their account. HOA collected on insurance policy due to fraud, management company was referred to the State for prosecution.

Employee Embezzlement

Longtime employee was stealing customer payments on AR. Forensic tracing of timestamped reports and customer receipts clearly showed how employee was working the scheme. Employee took plea deal with DA.

According to the “Occupational Fraud 2024: A Report to the Nations”

With losses this huge nationwide, every missing dollar hurts, see how defensible evidence flips the odds and protects what’s yours.

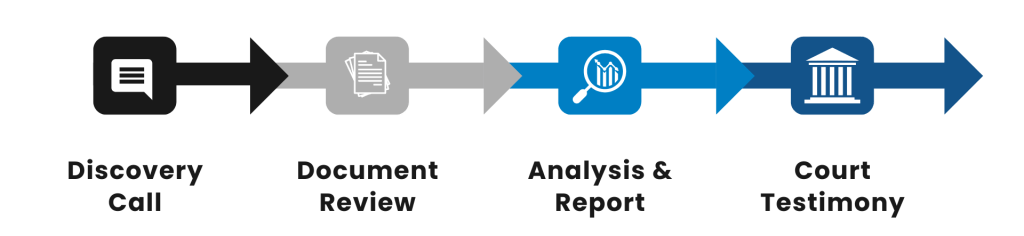

Most engagements begin within 48–72 hours after we review initial documents and sign the engagement letter.

Bank statements, GL exports, invoices, payroll records, and any suspicious correspondence. If you’re missing items, we’ll draft the subpoena list.

We operate on a set hourly billing rate; no contingency.

We provide full expert-witness testimony and deposition support; you only testify if counsel requests.

Simple cases 5–10 business days; complex multi-year schemes 4–8 weeks.